Welcome to Censeo

Thank you for visiting our website. We specialise in affordable home ownership mortgages to make your home-owning aspirations a reality.

Our experienced, friendly, and knowledgeable mortgage advisors are here to help you secure the best mortgage for your personal needs.

We work with some of the UK’s leading housing associations and developers and will help you secure a home that you can sustain and afford.

Our website is designed to get you started, you can call us on 0207 090 7290.

We work hard to take care of our customers and continue to support you with regular reviews to ensure you always have the best mortgage advice available.

Financial Assessments

Financial Assessment

We are pleased to launch our new assessment portal for those looking to buy a new or resale (previously owned) affordable home. Click on the box to Begin your assessment

Check your credit score using the link below

Get your credit reportNext steps

Once you have found a property, the housing association or developer will require confirmation you can secure a mortgage quickly. Please log on to our property assessment portal to undertake a full financial assessment

The assessment will work out if you can be approved and afford the property you are interested in.

It will take 10-15 minutes to complete. We also suggest that you get a copy of your credit report.

Once completed you and your housing association or developer will receive notification from us by email.

Our team are on the end of the phone to assist with any queries and to secure you a great mortgage.

Tel. 0207 090 7290 (9am – 5.30pm Monday to Friday excl. Bank Holidays)

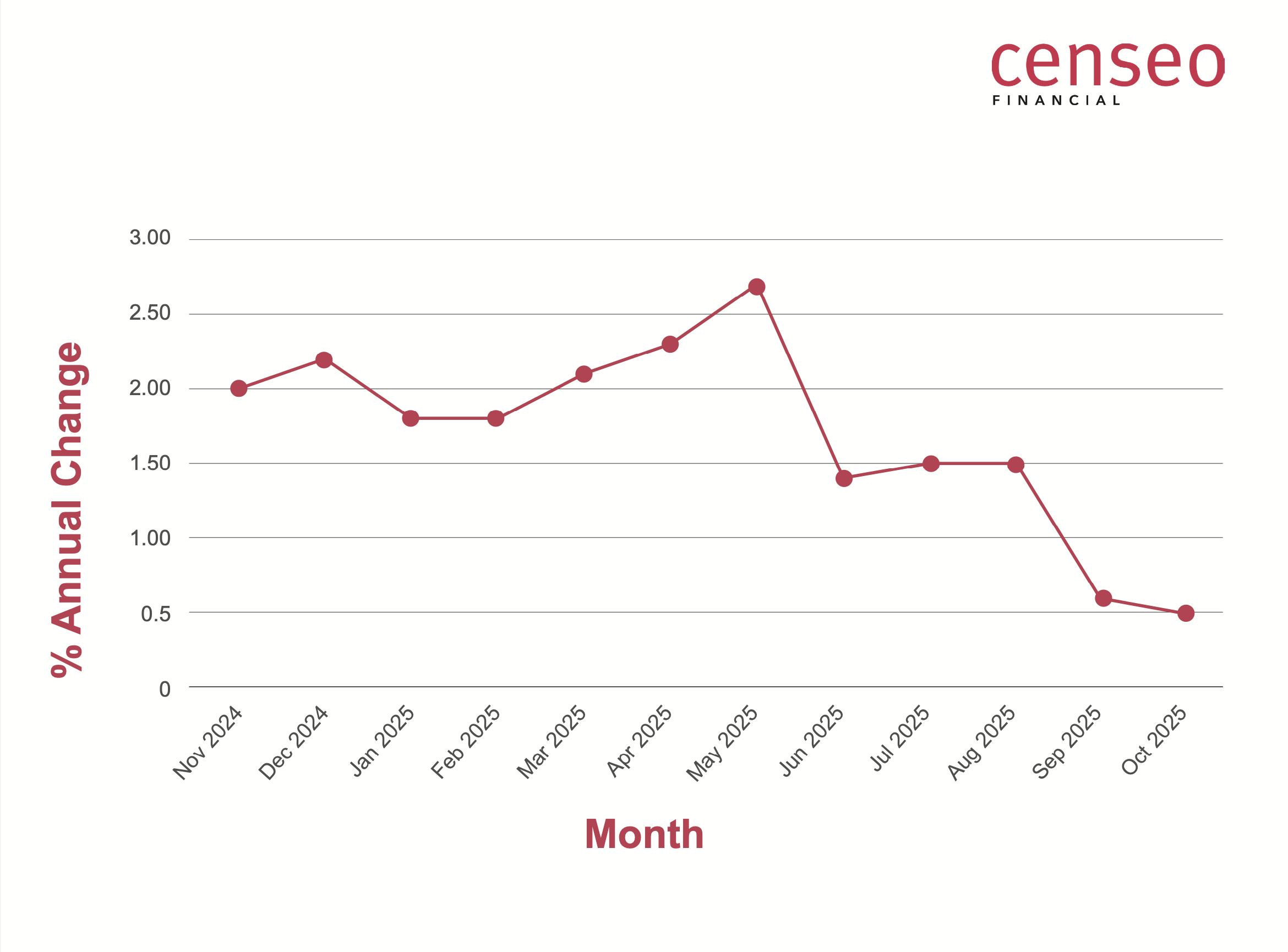

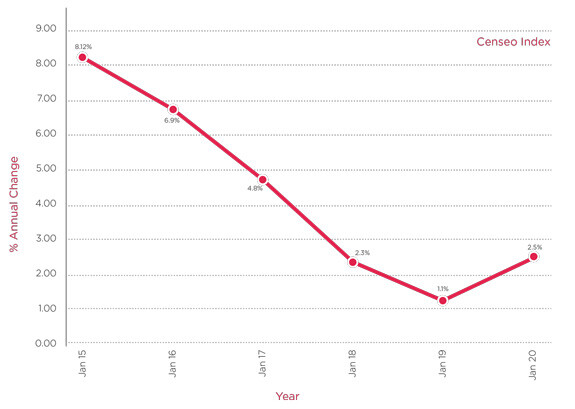

Censeo Index

Censeo Index

We have our very own Censeo Index, which is simply an average of all the other indices. Where an index reports a monthly change, we have annualised the figure for the purposes of the Censeo Index.

| Avg Home Price (England & Wales) |

Change (12 month period) |

Trend | |

|---|---|---|---|

| Nationwide | £264,249 | ||

| Halifax | £288,688 | ||

| LSL Academtrics | £356,014 | ||

| Rightmove | £375,110 | ||

| Land Registry | £281,373 | ||

| Censeo Index | £313,087 |

Contact Us

Sign Up for the latest news

Get in Touch

Our office hours are 9am-5:30pm Monday to Friday excluding public holidaysAddress: Oriel House. 26 The Quadrant, Richmond, Surrey, TW9 1DL.

Tel: 0207 090 7290

Email: info@censeo-financial.com

We will charge a broker fee of up to £495, payable on application. The amount we will charge is dependent on the amount of research and administration that is required.

Your home may be repossessed if you do not keep up repayments on your mortgage.

The guidance and/or advice contained within this website is subject to the UK regulatory regime and is therefore primarily targeted at consumers based in the UK.

Most Buy to Let Mortgages are not regulated by the Financial Conduct Authority.